Missouri Tax Credits

70% Missouri State Tax Credits

Financial gifts to Good Shepherd of $1,000 or more are eligible for a 70% Missouri tax credit, which is a dollar-for-dollar reduction of the Missouri state income tax you owe. For example, if you owe $700 in Missouri taxes at the end of 2022, but you receive $700 in tax credits, your net liability drops immediately to $0.

Your gift will directly impact mothers, children and families across the Archdiocese of St. Louis while also providing a benefit to you.

Please contact Walker Hill, III at 314.854.5705 or whill@gsstl.org for more details.

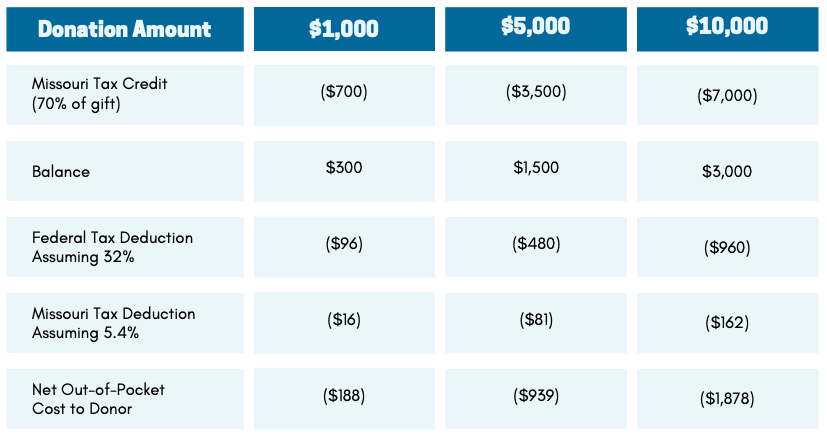

Tax Credit Information

The below chart is is an example of how tax credits could help you meet your charitable goals. This is not to be taken as tax advice. Consult your tax advisor.

Am I eligible?

Individuals, LLCs, partnerships, banks, or corporations that have Missouri tax liability are eligible.

How can tax credits be used?

Donors have up to one year from the date of the contribution to complete the application process,

but have up to two years to use credits to offset State income tax liability. Credits shall not exceed the donor’s liability in the tax year it is claimed.

How do I give?

1. Make a cash, credit card or stock contribution ($1,000 or more) to Good Shepherd. Write “tax credit” in the check memo line.

2. Complete the application that accompanies your acknowledgement and return it to Good Shepherd at 1340 Partridge Avenue, St. Louis, MO 63130 for verification and forwarding to the State.

Get Help Now

Get Help Now